Frequently Asked Questions

Plaintiffs are former AMI workers who were classified by AMI as independent contractors while working at a Dignity medical facility. The Action accuses Defendants of violating California labor laws by failing to pay overtime wages, minimum wages, wages due upon termination and reimbursable expenses and failing to provide meal periods, rest breaks and accurate itemized wage statements. Based on the same claims, Plaintiffs have also asserted a claim for civil penalties under the California Private Attorneys General Act (Labor Code §§ 2698, et seq.) (“PAGA”). Plaintiffs are represented by attorneys in the Action: Zimmerman Reed (“Class Counsel”) and The Bononi Law Group.

Defendants strongly deny violating any laws or failing to pay any wages and contend they complied with all applicable laws.

So far, the Court has made no determination whether Defendants or Plaintiffs are correct on the merits. In the meantime, Plaintiffs and Defendants hired an experienced and neutral mediator in an effort to resolve the Action by negotiating an end to the case by agreement (settle the case) rather than continuing the expensive and time-consuming process of litigation. The negotiations were successful. By signing a lengthy written settlement agreement (“Agreement”) and agreeing to jointly ask the Court to enter a judgment ending the Action and enforcing the Agreement, Plaintiffs and Defendants have negotiated a proposed Settlement that is subject to the Court’s Final Approval. Both sides agree the proposed Settlement is a compromise of disputed claims. By agreeing to settle, Defendants do not admit any violations or concede the merit of any claims.

Plaintiffs and Class Counsel strongly believe the Settlement is a good deal for you because they believe that: (1) AMI has agreed to pay a fair, reasonable and adequate amount considering the strength of the claims and the risks and uncertainties of continued litigation; and (2) Settlement is in the best interests of the Class Members and Aggrieved Employees. The Court preliminarily approved the proposed Settlement as fair, reasonable and adequate, authorized the Notice, and scheduled a hearing to determine Final Approval.

1. AMI Will Pay $1,500,000.00 as the Gross Settlement Amount (“Gross Settlement”). AMI has agreed to deposit the Gross Settlement into an account controlled by the Administrator of the Settlement. The Administrator will use the Gross Settlement to pay Individual Class Payments, Individual PAGA Payments, the California Labor and Workforce Development Agency (“LWDA”) PAGA Payment, Class Counsel Fees, Class Counsel Litigation Expenses, Class Representative Service Payments, and Administration Expenses Payment. Assuming the Court grants Final Approval, AMI will fund the Gross Settlement not more than 14 calendar days after the Judgment entered by the Court becomes final. The Judgment will be final on the date upon which the time for appeal of the Court’s entry of Judgment expires, or a later date if the Judgment is appealed.

2. Court Approved Deductions from Gross Settlement. At the Final Approval Hearing, Plaintiffs and/or Class Counsel will ask the Court to approve the following deductions from the Gross Settlement, the amounts of which will be decided by the Court at the Final Approval Hearing:

A. Up to $500,000.00 (1/3 of the Gross Settlement) to Class Counsel for attorneys’ fees and up to $25,000 for their litigation expenses. To date, Class Counsel have worked and incurred expenses on the Action without payment.

B. Up to $10,000.00 to each Plaintiff Sarah Padron, Lori Heuser and Ryan Willis as a Class Representative Service Payment for filing the Action, working with Class Counsel, and representing the Class. Plaintiffs will also receive Plaintiffs’ Individual Class Payment and any Individual PAGA Payment.

C. Up to $10,415.00 to the Administrator for services administering the Settlement.

D. Up to $40,000.00 for PAGA Penalties, 75% allocated to the LWDA PAGA Payment ($30,000.00) and 25% in Individual PAGA Payments to the Aggrieved Employees ($10,000.00) based on their number of PAGA Pay Periods worked.

Participating Class Members have the right to object to any of these deductions. The Court will consider all objections.

3. Net Settlement Amount Distributed to Class Members. After making the above deductions in amounts approved by the Court, the Administrator will distribute the rest of the Gross Settlement Amount (the “Net Settlement Amount”) by making Individual Class Payments to Participating Class Members. Individual Class Payment is the greater of the amount determined by each individual Participating Class Member’s Overtime Score multiplied by the Pro Rata Fraction or $300.00.

4. Taxes Owed on Payments to Class Members. Plaintiffs and Defendants are asking the Court to approve an allocation of 20% of each Individual Class Payment to taxable wages (“Wage Portion”) and 80% to interest and penalties (“Non-Wage Portion”). The Wage Portion is subject to withholdings and will be reported on IRS W-2 Forms. All employer payroll taxes owed on the Wage Portion will be paid by AMI. Participating Class Members assume full responsibility and liability for any employee taxes owed on their Individual Class Payment. The Individual PAGA Payments are counted as penalties rather than wages for tax purposes. The Administrator will report the Individual PAGA Payments and the Non-Wage Portions of the Individual Class Payments on IRS 1099 Forms.

Although Plaintiffs and Defendants have agreed to these allocations, neither side is giving you any advice on whether your Individual Class Payments or Individual PAGA Payments are taxable or how much you might owe in taxes. You are responsible for paying all taxes (including penalties and interest on back taxes) on any Individual Class Payments or Individual PAGA Payments received from the proposed Settlement. You should consult a tax advisor if you have any questions about the tax consequences of the proposed Settlement.

5. Need to Promptly Cash Payment Checks. The front of every check issued for Individual Class Payments and Individual PAGA Payments will show the date when the check expires (the void date). If you don’t cash it by the void date, your check will be automatically cancelled, and the monies will be deposited with the California Controller’s Unclaimed Property Fund in your name.

If the monies represented by your check are sent to the Controller’s Unclaimed Property, you should consult the rules of the Fund for instructions on how to retrieve your money.

6. Requests for Exclusion from the Class Settlement (Opt-Outs). You will be treated as a Participating Class Member, participating fully in the Class Settlement, unless you notify the Administrator in writing, not later than July 14, 2025, that you wish to opt-out. The easiest way to notify the Administrator is to send a written and signed Request for Exclusion by July 14, 2025. The Request for Exclusion should be a letter from a Class Member or his/her representative setting forth a Class Member’s name, present address, telephone number, approximate dates of employment, and social security number for verification purposes, and a simple statement electing to be excluded from the Settlement. Be sure to personally sign your request and identify the Action as In Re: Padron et al. v. AMI Expeditionary Healthcare et al. Excluded Class Members (i.e., Non-Participating Class Members) will not receive Individual Class Payments, but will preserve their rights to personally pursue wage and hour claims against Defendants.

You cannot opt-out of the PAGA portion of the Settlement. Class Members who exclude themselves from the Class Settlement (Non-Participating Class Members) remain eligible for Individual PAGA Payments and are required to give up their right to assert PAGA claims against Defendants based on the PAGA Period facts alleged in the Action.

7. The Proposed Settlement Will Be Void if the Court Denies Final Approval. It is possible the Court will decline to grant Final Approval of the Settlement or decline enter a Judgment. It is also possible the Court will enter a Judgment that is reversed on appeal. Plaintiffs and Defendants have agreed that, in either case, the Settlement will be void: AMI will not pay any money and Class Members will not release any claims against Defendants.

8. Administrator. The Court has appointed a neutral company, Atticus Administration, LLC (the “Administrator”) to send the Notice, calculate and make payments, and process Class Members’ Requests for Exclusion. The Administrator will also decide Class Member Challenges over the Workweeks and PAGA Pay Periods, mail and re-mail settlement checks and tax forms, and perform other tasks necessary to administer the Settlement. The Administrator’s contact information is contained in Section 9 of the Notice.

9. Participating Class Members’ Release. After the Judgment is final and AMI has fully funded the Gross Settlement (and separately paid all employer payroll taxes), Participating Class Members will be legally barred from asserting any of the claims released under the Settlement. This means that unless you opted out by validly excluding yourself from the Class Settlement, you cannot sue, continue to sue, or be part of any other lawsuit against Defendants or related entities for wages based on the Class Period facts and PAGA penalties based on PAGA Period facts, as alleged in the Action and resolved by this Settlement.

The Participating Class Members will be bound by the following release:

All Participating Class Members, on behalf of themselves and their respective former and present representatives, agents, attorneys, heirs, administrators, successors and assigns, release Released Parties from all claims that were alleged, or reasonably could have been alleged, based on the Class Period facts stated in the Operative Complaint and ascertained in the course of the Action, including, e.g., (a) failure to pay overtime; (b) failure to pay earned wages; (c) unlawful collection or receipt of wages; (d) failure to provide meal breaks; (e) failure to provide rest breaks; (f) failure to provide accurate wage statements; (g) failure to pay waiting time penalties; (h) failure to provide or reimburse business expenses; (i) violation of California Business and Professions Code; (j) civil penalties pursuant to Private Attorneys’ General Act (“PAGA”) that could have been premised on the claims, causes of action or legal theories described above or any of the claims, causes of action or legal theories of relief pleading in the Operative Complaint, including but not limited to, Labor Code sections 202, 203, 204, 221, 226, 226.7, 510, 1194, 1198, 1119, 2800, 2803, IWC Wage Order Nos. 1-2001 section 3, and Business and Professions Code section 17200 et seq.; and (k) violation of the Fair Labor Standards Act, 29 U.S.C. sections 201 et seq.. Except as set forth in Section 5.3 of this Agreement, Participating Class Members do not release any other claims, including claims for vested benefits, wrongful termination, violation of the Fair Employment and Housing Act, unemployment insurance, disability, social security, workers’ compensation or claims based on facts occurring outside the Class Period.

Participating Class Members who timely cash or otherwise negotiate their settlement payment check will be deemed to have opted into the Action, as amended, for purposes of the FLSA and, as to those Participating Class Members, the Released Class Claims include any and all claims the Participating Class Members may have under the FLSA during the Class Period arising from the facts alleged in the Action, as amended, or that could have been alleged based on the facts alleged. Only those Participating Class Members who timely cash or otherwise negotiate their settlement payment check will be deemed to have opted into the Action for purposes of the FLSA and thereby release and waive any of their claims under the FLSA arising under or relating to the alleged claims. To secure releases of the FLSA claims, FLSA release language will be added to the checks that class members will need to sign to receive their benefits. Upon entry of Judgment, Participating Class Members are precluded from filing a wage and hour action under the Fair Labor Standards Act against the Released Parties for claims and/or causes of action encompassed by the Released Class Claims which are extinguished and precluded pursuant to the holding in Rangel v. PLS Check Cashers of California, Inc., 899 F.3d 1106 (2018).

10. Aggrieved Employees’ PAGA Release. After the Court’s judgment is final, and AMI has paid the Gross Settlement, all Aggrieved Employees will be barred from asserting PAGA claims against Defendants, whether or not they exclude themselves from the Settlement. This means that all Aggrieved Employees, including those who are Participating Class Members and those who opt-out of the Class Settlement, cannot sue, continue to sue, or participate in any other PAGA claim against Defendants or their related entities based on the PAGA Period facts alleged in the Action and resolved by this Settlement.

The Aggrieved Employees’ Releases for Participating and Non-Participating Class Members are as follows:

All Non-Participating Class Members who are Aggrieved Employees are deemed to release, on behalf of themselves and their respective former and present representatives, agents, attorneys, heirs, administrators, successors and assigns, the Released Parties from all claims for PAGA penalties that were alleged, or reasonably could have been alleged, based on the PAGA Period facts stated in the Operative Complaint, the PAGA Notice, and ascertained in the course of the Action, including, e.g., (a) failure to pay overtime; (b) failure to pay earned wages; (c) unlawful collection or receipt of wages; (d) failure to provide meal breaks; (e) failure to provide rest breaks; (f) failure to provide accurate wage statements; (g) failure to pay waiting time penalties; (h) failure to provide or reimburse business expenses; (i) violation of California Business and Professions Code; (j) civil penalties pursuant to Private Attorneys General Act (“PAGA”) that could have been premised on the claims, causes of action or legal theories described above or any of the claims, causes of action or legal theories of relief pleading in the Operative Complaint, including but not limited to, Labor Code sections 202, 203, 204, 221, 226, 226.7, 510, 1194, 1198, 1119, 2800, 2803, IWC Wage Order Nos. 1-2001 section 3, and Business and Professions Code section 17200 et seq.; and (k) violation of the Fair Labor Standards Act, 29 U.S.C sections 201 et seq. Aggrieved Employees will be bound by the release of the Released PAGA Claims regardless of their decision to participate in or opt-out of the release of the Released Class Claims.

1. Individual Class Payments. The Administrator will calculate each Individual Class Payment, which is the greater of the amount determined by each individual Participating Class Member’s Overtime Score multiplied by the Pro Rata Fraction or Three Hundred Dollars and Zero Cents ($300.00).

A. “Overtime Score” means the difference between the total wages, including straight time and overtime, earned by the Participating Class Member based on the reported hours worked on a per-Workweek basis, and the total wages calculated solely as straight time for those same hours.

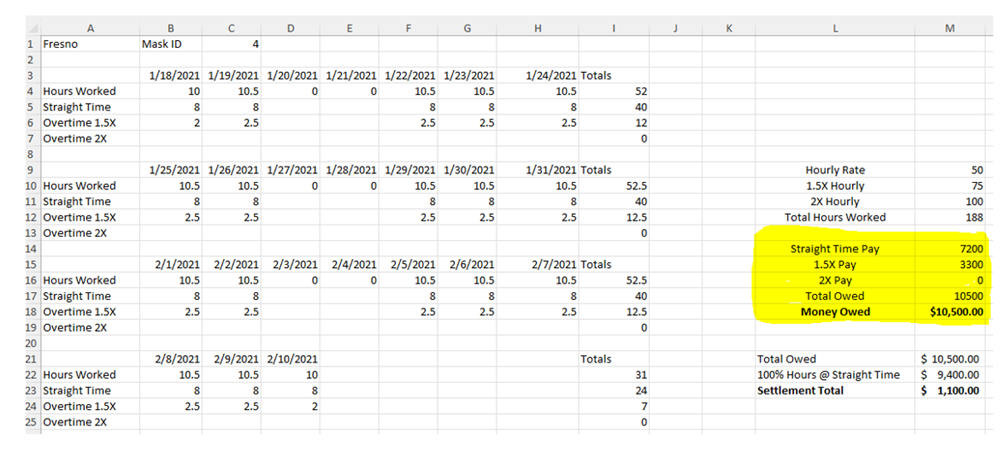

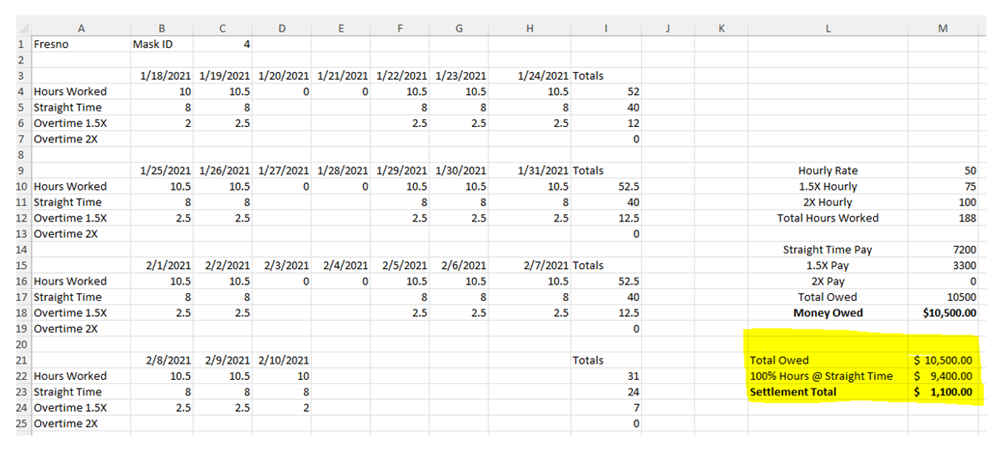

For example, the Overtime Score for Fresno Employee #4 is $1,100, and is calculated as follows:

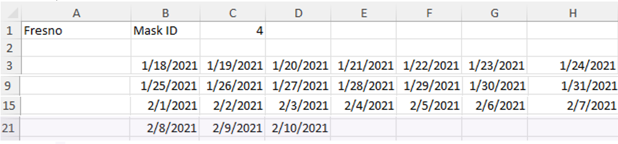

1. Step 1: Determine the days worked Monday through Sunday in a workweek (“Workweek”):

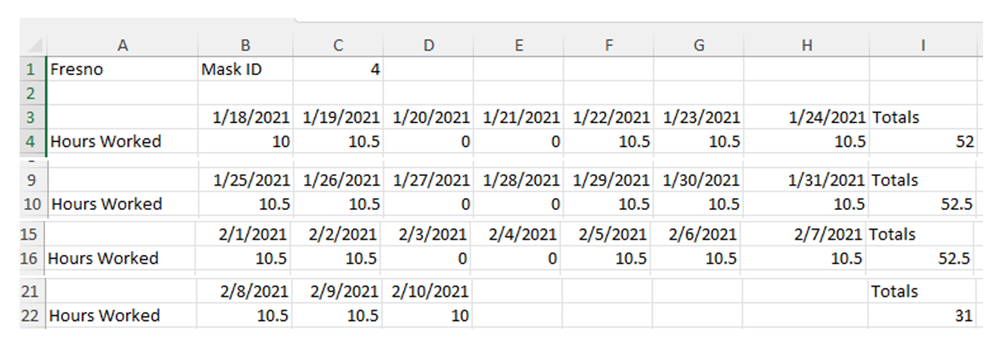

2. Step 2: Determine the hours worked per day and add them together to get the hours worked per Workweek:

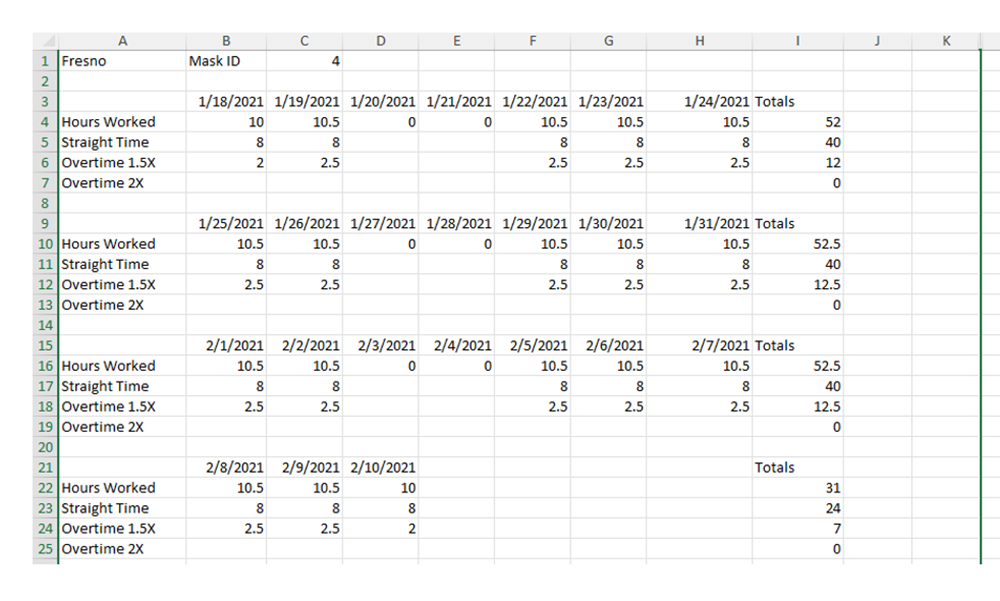

3. Step 3: Determine the following per day and per week:

(a) Straight Time 1.0X (8 hours or less, if any);

(b) Overtime 1.5X (greater than 8 hours, but less than or equal to 12 hours, if any); and

(c) Overtime 2X (greater than 12 hours, if any):

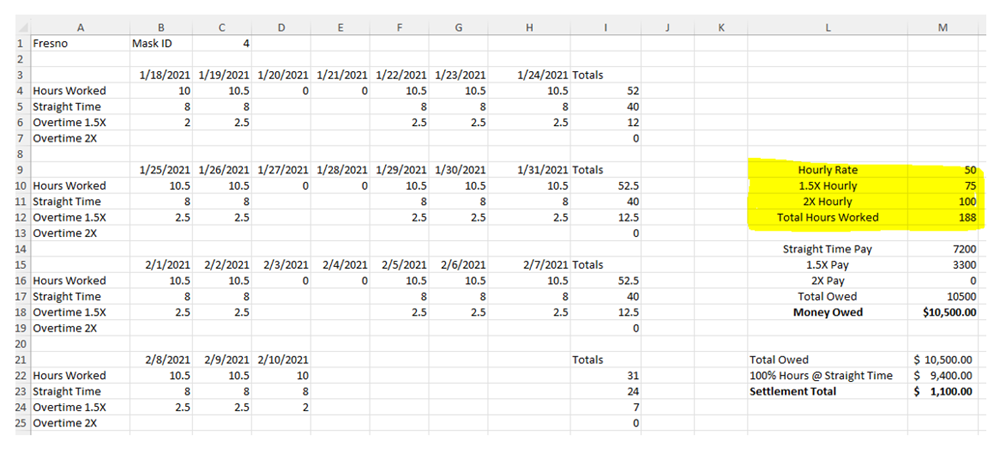

4. Step 4: Determine the following:

(a) Actual Hourly Rate ($50);

(b) Overtime 1.5X Hourly Rate ($75);

(c) Overtime 2X Hourly Rate ($100); and

(d) Total Hours worked (188):

5. Step 5: Determine the Money Owed ($10,500) as follows:

(a) calculating the Straight Time Pay ($50 times 144 hours = $7200);

(b) calculating the Overtime 1.5X Pay ($75 times 44 hours = $3300);

(c) calculating the Overtime 2X Pay ($100 times 0 hours = $0); and

(d) adding them together ($7200 + $3300 + $0 = $10,500):

6. Step 6: Determine the Settlement Total (aka Overtime Score) ($1,100) by:

(a) Taking the total Money Owed for straight and overtime ($10,500), and

(b) Subtracting the sum of 100% of the Straight Time Hours Worked (188) paid ($50) (188 hours x $50 = $9,400), which leaves $1,100 for the Overtime Score:

B. “Pro Rata Fraction” means the amount determined by dividing the Net Settlement Amount by the Estimated Overtime Maximum.

1. “Net Settlement Amount” means the Gross Settlement Amount, less the following payments in the amounts approved by the Court: Individual PAGA Payments, the LWDA PAGA Payment, Class Representative Service Payments, Class Counsel Fees Payment, Class Counsel Litigation Expenses Payment, and the Administration Expenses Payment.

For example:

| Gross Settlement Amount: | $1,500,000.00 |

| Class Counsel for attorneys’ fees: | – up to $500,000.00 |

| Class Counsel litigation expenses: | – up to $25,000.00 |

| Class Representative Service Payments: | – up to $30,000.00 |

| Administrator services: | – up to $10,415.00 |

| PAGA Penalties: | – up to $40,000.00 |

| Net Settlement Amount: | $894,585.00 |

2. “Estimated Overtime Maximum” means One Million, Three Hundred and Thirty-Seven Thousand, Five Hundred and Fifteen Dollars ($1,337,515.00).

The Estimated Overtime Maximum is the sum of all the Class’s Overtime Scores to estimate the total overtime owed to the Class based on Defendants’ records. The amounts broken down by Defendants’ job sites are:

Fresno = $46,870.75

San Carlos = $107,951.90

San Diego = $11,287.38

San Mateo 2020 = $585,139.38

San Mateo 2021 = $586,265.63

Total = $1,337,515.04

Thus, the Pro Rata Fraction is $894,585.00 ÷ $1,337,515.04 = 66.8%

C. Accordingly, the Individual Class Payment for Fresno Employee #4 is:

$1,100 (the Overtime Score) x 66.8% (the Pro Rata Fraction) = $735.73

D. In the event that the Net Settlement Amount is insufficient to pay each Individual Class Payment, the Administrator shall reduce on a pro rata basis each Individual Class Payment for those Participating Class Members eligible to receive more than the $300 payment and allocate that amount to those Participating Class Members who are eligible to receive the $300 payment in order to effectuate the Parties’ intent that each Participating Class Member receives a minimum payment of $300.

2. Individual PAGA Payments. The Administrator will calculate Individual PAGA Payments by (a) dividing the amount of the Aggrieved Employees’ 25% share of PAGA Penalties in the amount of $10,000 by the total number of PAGA Pay Periods worked by all Aggrieved Employees during the PAGA Period and (b) multiplying the result by each Aggrieved Employee’s PAGA Pay Periods.

3. Challenges. You may challenge the Workweeks and PAGA Pay Periods credited to you. The number of Workweeks and the PAGA Pay Periods worked during the PAGA Period, as recorded in AMI’s records, are stated in the second and third page of the Notice. You have until July 14, 2025 to challenge the Workweeks and PAGA Pay Periods credited to you. You can submit your challenge by signing and sending a letter to the Administrator via mail, email or fax. Section 9 of the Notice has the Administrator’s contact information.

You need to support your challenge by sending copies of pay stubs or other records. The Administrator will accept AMI’s calculation of Workweeks and PAGA Pay Periods based on AMI’s records as accurate unless you send copies of records containing contrary information. You should send copies rather than originals because the documents will not be returned to you. The Administrator will resolve Workweeks and PAGA Pay Periods challenges based on your submission and on input from Class Counsel (who will advocate on behalf of Participating Class Members) and AMI’s Counsel. The Administrator’s decision is final. You can’t appeal or otherwise challenge its final decision.

1. Participating Class Members. The Administrator will send, by U.S. mail, a single check to every Participating Class Member (i.e., every Class Member who does not opt-out) including those who also qualify as Aggrieved Employees. The single check will combine the Individual Class Payment and the Individual PAGA Payment.

2. Non-Participating Class Members. The Administrator will send, by U.S. mail, a single Individual PAGA Payment check to every Aggrieved Employee who opts out of the Class Settlement (i.e., every Non-Participating Class Member).

Your check will be sent to the same address as the Notice. If you change your address, be sure to notify the Administrator as soon as possible. Section 9 of the Notice has the Administrator’s contact information.

Submit a written and signed letter with your name, present address, telephone number, and a simple statement that you do not want to participate in the Settlement by fax, email, or mail. The Administrator will exclude you based on any writing communicating your request be excluded. Be sure to personally sign your request, identify the Action as In Re: Padron et al. v. AMI Expeditionary Healthcare et al. and include your identifying information (full name, address, telephone number, approximate dates of employment, and social security number for verification purposes). You must make the request yourself. If someone else makes the request for you, it will not be valid. The Administrator must be sent your request to be excluded by July 14, 2025, or it will be invalid. Section 9 of the Notice has the Administrator’s contact information.

Only Participating Class Members have the right to object to the Settlement. Before deciding whether to object, you may wish to see what Plaintiffs and Defendants are asking the Court to approve. At least 16 court days before the August 19, 2025 Final Approval Hearing, Class Counsel and/or Plaintiffs will file in Court (1) a Motion for Final Approval that includes, among other things, the reasons why the proposed Settlement is fair, and (2) a Motion for Class Counsel Fees Payment and Class Litigation Expenses Payment stating (i) the amount Class Counsel is requesting for attorneys’ fees and litigation expenses; and (ii) the amount Plaintiffs are requesting as Class Representative Service Payments. Upon reasonable request, Class Counsel (whose contact information is in Section 9 of the Notice) will send you copies of these documents at no cost to you. You can also view them on the Administrator’s Website www.AMISettlement.com or the Court’s website https://www.lacourt.org/.

A Participating Class Member who disagrees with any aspect of the Agreement, the Motion for Final Approval and/or Motion for Class Counsel Fees Payment and Class Litigation Expenses Payment may wish to object, for example, that the proposed Settlement is unfair, or that the amounts requested by Class Counsel or Plaintiffs are too high or too low. The deadline for sending written objections to the Administrator is July 14, 2025. Be sure to tell the Administrator what you object to, why you object, and any facts that support your objection. Make sure you identify the Action In Re: Padron et al. v. AMI Expeditionary Healthcare et al. and include your name, current address, telephone number, and approximate dates of work for AMI in California during the Class Period and/or PAGA period and sign the objection. Section 9 of the Notice has the Administrator’s contact information.

Alternatively, a Participating Class Member can object (or personally retain a lawyer to object at your own cost) by attending the Final Approval Hearing. You (or your attorney) should be ready to tell the Court what you object to, why you object, and any facts that support your objection. See Section 8 of the Notice (immediately below) for specifics regarding the Final Approval Hearing.

You can, but don’t have to, attend the Final Approval Hearing on August 19, 2025 at 10:00 a.m. in Department 14 of the Los Angeles Superior Court, located at 312 North Spring Street, Los Angeles, CA 90012. At the Hearing, the judge will decide whether to grant Final Approval of the Settlement and how much of the Gross Settlement will be paid to Class Counsel, Plaintiffs, and the Administrator. The Court will invite comment from objectors, Class Counsel and Defense Counsel before making a decision. You can attend (or hire a lawyer to attend) either personally or virtually via LACourtConnect (https://www.lacourt.org/lacc/). Check the Court’s website for the most current information.

It’s possible the Court will reschedule the Final Approval Hearing. You should check the Administrator’s Important Dates page HERE beforehand or contact Class Counsel to verify the date and time of the Final Approval Hearing.

The Agreement sets forth everything Defendants and Plaintiffs have promised to do under the proposed Settlement. The easiest way to read the Agreement, the Judgment or any other Settlement documents is to go to the Administrator’s website HERE. You can also telephone or send an email to Class Counsel or the Administrator using the contact information listed below or consult the Superior Court website by going to https://www.lacourt.org/casesummary/ui and entering the Case Number for the Action, Case No. 21STCV43932. You can also make an appointment to personally review court documents in the Clerk’s Office at the Spring Street Courthouse by calling (213) 310-7000.

DO NOT TELEPHONE THE SUPERIOR COURT TO OBTAIN INFORMATION ABOUT THE SETTLEMENT.

Class Counsel:

ZIMMERMAN REED LLP

Caleb Marker (SBN 269721)

caleb.marker@zimmreed.com

Jeff S. Westerman (SBN 94559)

jeff.westerman@zimmreed.com

6420 Wilshire Blvd., Suite 1080

Los Angeles, CA 90048

Telephone (877) 500-8780

Facsimile (877) 500-8781

David Cialkowski (pro hac vice)

1100 IDS Center, 80 South 8th Street

Minneapolis, MN 55402

Telephone (612) 341-0400

Settlement Administrator:

Name of Company: Atticus Administration, LLC.

Email Address: AMISettlement@atticusadmin.com

Mailing Address: PO Box 64053, Saint Paul, MN 55164

Telephone: 1-888-787-8264

If you lose or misplace your settlement check before cashing it, the Administrator will replace it as long as you request a replacement before the void date on the face of the original check. If your check is already void, you should consult the Unclaimed Property Fund (https://www.sco.ca.gov/search_upd.html) for instructions on how to retrieve the funds.

To receive your check, you should immediately notify the Administrator if you move or otherwise change your mailing address.